Is debt harmful to a company?

Generally, too much debt is a bad thing for companies and shareholders because it inhibits a company's ability to create a cash surplus. Furthermore, high debt levels may negatively affect common stockholders, who are last in line for claiming payback from a company that becomes insolvent.

Debt can be a useful tool to start your business, but make sure your debt is working for you, not against you. If your debt and expenses begin to outpace your revenue, this can lead to significant financial problems.

Debt financing can save a small business big money

A big advantage of debt financing is the ability to pay off high-cost debt, reducing monthly payments by hundreds or even thousands of dollars. Reducing your cost of capital boosts business cash flow.

How much debt should a small business have? As a general rule, you shouldn't have more than 30% of your business capital in credit debt; exceeding this percentage tells lenders you may be not profitable or responsible with your money.

1 The downside of debt financing is that lenders require the payment of interest, meaning the total amount repaid exceeds the initial sum. Also, payments on debt must be made regardless of business revenue. For smaller or newer businesses, this can be especially dangerous.

Debt provides an opportunity to extend your cash runway between raise rounds. If your burn rate leaves you without enough time and funds until more capital can be raised, debt is a worthwhile consideration. Working to increase sales and reduce expenses is also worthwhile, but results are not guaranteed.

You can calculate this by taking a company's total debt from its balance sheet and dividing by its EBITDA, which can be found on the income statement. Normal debt levels can vary, but a debt-to-EBITDA ratio above the 4-5 range is typically considered high.

Total debt on the balance sheet as of December 2023 : $9.57 B. According to Tesla's latest financial reports the company's total debt is $9.57 B. A company's total debt is the sum of all current and non-current debts.

Generally speaking, a good debt-to-income ratio is anything less than or equal to 36%. Meanwhile, any ratio above 43% is considered too high. The biggest piece of your DTI ratio pie is bound to be your monthly mortgage payment.

Wealthy individuals create passive income through arbitrage by finding assets that generate income (such as businesses, real estate, or bonds) and then borrowing money against those assets to get leverage to purchase even more assets.

What companies are in the most debt?

Fannie Mae is the world's largest debtor, carrying $4.232 trillion in debt. U.S. companies make up 60.13% of the $10.8 trillion owed by the top 100 global companies in debt. Toyota holds the title of the world's most indebted company outside the financial industries, with a debt of $221.13 billion.

one key risk to a bondholder is that the company may fail to make timely payments of interest or principal. If that happens, the company will default on its bonds. this “default risk” makes the creditworthiness of the company—that is, its ability to pay its debt obligations on time—an important concern to bondholders.

Total debt on the balance sheet as of December 2023 : $14.54 B. According to Netflix's latest financial reports the company's total debt is $14.54 B. A company's total debt is the sum of all current and non-current debts.

Total debt on the balance sheet as of December 2023 : $108.04 B. According to Apple's latest financial reports the company's total debt is $108.04 B. A company's total debt is the sum of all current and non-current debts.

Total debt on the balance sheet as of December 2023 : $135.61 B. According to Amazon's latest financial reports the company's total debt is $135.61 B. A company's total debt is the sum of all current and non-current debts.

“That's because the best balance transfer and personal loan terms are reserved for people with strong credit scores. $20,000 is a lot of credit card debt and it sounds like you're having trouble making progress,” says Rossman.

Credit card debt is always difficult to deal with, but as it gets larger, paying it back gets a whole lot harder. If your total credit card balances are $25,000 or higher, they'll go up by hundreds of dollars every month because of interest. And it could cost you $500 or more just to make minimum payments.

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals.

Wealthy people aren't afraid of borrowing. But they typically don't borrow money to live beyond their means or because they failed to save for emergencies or make a plan to cover expenses. Instead, rich people tend to use debt as a tool to help them build more wealth.

Myth 1: Being debt-free means being rich.

Having debt simply means that you owe money to creditors. Being debt-free often indicates sound financial management, not necessarily an overflowing bank account. It's more about peace of mind and less about the balance in one's account.

Why is debt tax free?

When you take out a loan, you don't have to pay income taxes on the proceeds. The IRS does not consider borrowed money to be income. If the creditor cancels the loan, with some exceptions the amount of the forgiveness usually does become income.

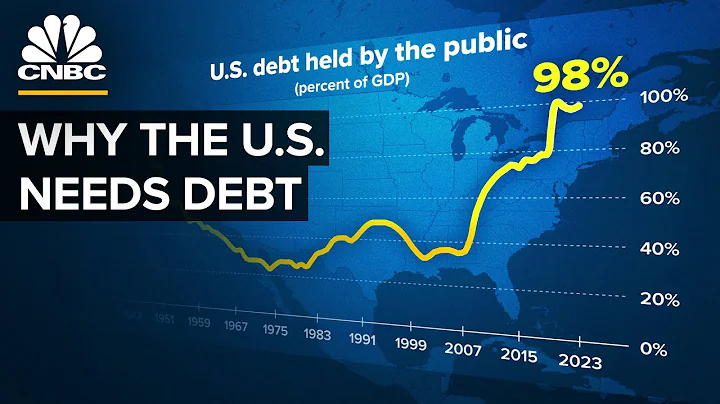

At the top is Japan, whose national debt has remained above 100% of its GDP for two decades, reaching 255% in 2023. *For the U.S. and Canada, gross debt levels were adjusted to exclude unfunded pension liabilities of government employees' defined-benefit pension plans.

The United States has the world's highest national debt with $30.1 trillion owed to creditors as of the first quarter of 2023. Washington's debt now stands at $31.4 trillion, raising further concerns about US government spending and borrowing costs.

United States. The United States boasts both the world's biggest national debt in terms of dollar amount and its largest economy, which resolves to a debt-to GDP ratio of approximately 128.13%.

Meaning that if a company cannot pay back its debt, banks are able to take ownership of a company's assets to eventually liquidate them for cash and settle the outstanding debt. In this manner, a company can lose many if not all of its assets.

References

- https://www.investopedia.com/terms/e/equityfinancing.asp

- https://www.investopedia.com/terms/c/costofdebt.asp

- https://blog.insight-experience.com/what-is-the-cost-of-capital-and-why-is-it-important

- https://www.riversaascapital.com/blog/why-do-companies-take-on-debt/

- https://www.toppr.com/ask/question/which-of-the-following-has-the-highest-cost-of-capital/

- https://www.business.com/articles/debt-vs-equity-financing/

- https://www.nerdwallet.com/article/small-business/equity-debt-financing

- https://homework.study.com/explanation/equity-capital-is-also-called.html

- https://www.toppr.com/ask/question/the-costliest-of-longterm-sources-of-finance-is/

- https://companiesmarketcap.com/apple/total-debt/

- https://www.miraeassetmf.co.in/knowledge-center/equity-vs-debt-funds

- https://valutico.com/weighted-average-cost-of-capital-explained-using-wacc-in-valuations/

- https://homework.study.com/explanation/which-of-the-following-is-a-reason-why-equity-capital-is-considered-riskier-than-debt-capital-a-equity-capital-has-a-higher-priority-claim-against-assets-and-earnings-b-equity-capital-remains-invested-in-a-firm-indefinitely-c-equity-capital-expec.html

- https://www.wellsfargo.com/goals-credit/smarter-credit/credit-101/debt-to-income-ratio/understanding-dti/

- https://worldpopulationreview.com/country-rankings/countries-by-national-debt

- https://www.fundingcircle.com/us/resources/how-much-debt-should-small-business-have/

- https://www.investopedia.com/ask/answers/013015/what-does-high-weighted-average-cost-capital-wacc-signify.asp

- https://www.linkedin.com/pulse/equity-securities-debt-sultan-h-alhaidar-cme-2

- https://www.aljazeera.com/economy/2023/5/31/infographic-how-does-us-debt-rank-compared-world

- https://corporatefinanceinstitute.com/resources/commercial-lending/debt-financing/

- https://fastercapital.com/content/The-Impact-of-Long-Term-Debt-on-Cost-of-Capital--A-Comprehensive-Study.html

- https://brainly.in/question/55245097

- https://www.investopedia.com/terms/i/incremental-cost-of-capital.asp

- https://byjus.com/commerce/differences-between-debt-and-equity-capital/

- https://www.wallstreetprep.com/knowledge/optimal-capital-structure/

- https://www.excedr.com/blog/cost-of-capital

- https://www.moneycontrol.com/news/mcminis/business/why-is-debt-cheaper-than-equity-7149681.html

- https://www.smallcase.com/learn/what-is-equity-share-capital/

- https://www.americanexpress.com/en-us/business/blueprint/resource-center/finance/pros-and-cons-of-debt-financing/

- https://dducollegedu.ac.in/Datafiles/cms/ecourse%20content/BMS-%20Cost%20of%20Capital.pdf

- https://fairness-finance.com/fairness-finance/finance/calculator/wacc.dhtml

- https://www.indeed.com/hire/c/info/wacc-formula

- https://www.accaglobal.com/gb/en/student/exam-support-resources/fundamentals-exams-study-resources/f9/technical-articles/optimum-capital-structure.html

- https://news.sky.com/story/surge-in-companies-raising-debt-is-one-of-the-most-eye-catching-developments-in-markets-13056144

- https://smartasset.com/taxes/when-is-debt-cancellation-tax-free

- https://www.investopedia.com/ask/answers/021115/how-do-you-calculate-ratio-between-debt-and-equity-cost-capital.asp

- https://www.investopedia.com/terms/c/capital.asp

- https://flgpartners.com/equity-vs-debt-financing-in-2022/

- http://anucde.info/sm20210803/Financial%20Management/Lession0009.pdf

- https://www.visualcapitalist.com/government-debt-by-country-advanced-economies/

- https://www.business-case-analysis.com/cost-of-capital.html

- https://www.investopedia.com/terms/c/capitalreduction.asp

- https://testbook.com/key-differences/difference-between-debt-and-equity

- https://www.thehartford.com/business-insurance/strategy/business-financing/equity-financing

- https://www.bajajfinserv.in/investments/equity-mutual-funds-vs-debt-mutual-funds

- https://insightscoop.substack.com/p/the-50-most-indebted-companies

- https://gocardless.com/guides/posts/debt-vs-equity-financing/

- https://www.investopedia.com/terms/o/optimal-capital-structure.asp

- https://www.investopedia.com/ask/answers/013015/what-difference-between-cost-equity-and-cost-capital.asp

- https://moneymentors.ca/money-tips/how-to-live-a-debt-free-life/

- https://www.fool.com/the-ascent/credit-cards/over-25k-credit-card-debt-pay-off/

- https://www.meritnation.com/karnataka-class-12-commerce/business-studies/business-finance-and-marketing-ncert-solution/financial-management/ncert-solutions/102_18_1880_3727_263_30457

- https://www.wallstreetmojo.com/capital-structure/

- https://quizlet.com/80403806/325-bec-3-cost-of-capital-flash-cards/

- https://companiesmarketcap.com/tesla/total-debt/

- https://tradingeconomics.com/aapl:us:equity-capital-and-reserves

- https://www.religareonline.com/blog/what-are-debentures/

- https://www.pineapplecf.com/post/how-to-determine-the-cost-of-equity-for-a-small-business

- https://www.fool.com/investing/2019/09/20/ask-a-fool-how-much-debt-is-too-much-for-a-company.aspx

- https://www.fool.com/terms/c/cost-of-debt/

- https://quizlet.com/108236792/chapter-18-financial-management-flash-cards/

- https://www.tryjeeves.com/blog/debt-vs-equity-financing

- https://hbr.org/2023/03/capital-is-expensive-again-now-what

- https://www.lightspeedhq.com/blog/advantages-of-debt-financing/

- https://online.hbs.edu/blog/post/cost-of-capital

- https://www.investopedia.com/terms/d/debtfinancing.asp

- https://www.unfcu.org/financial-wellness/50-30-20-rule/

- https://www.blackrock.com/us/individual/insights/cost-of-capital

- https://byjus.com/question-answer/the-cheapest-source-of-finance-isequity-share-capital-preference-share-retained-earning-debenture/

- https://www.theforage.com/blog/skills/debt-capital-markets

- https://typeset.io/questions/what-are-the-advantages-and-disadvantages-of-using-the-wacc-2f5o2szdcj

- https://www.investopedia.com/ask/answers/032515/how-does-company-choose-between-debt-and-equity-its-capital-structure.asp

- https://www.investopedia.com/articles/investing/062813/why-companies-issue-bonds.asp

- https://corporatefinanceinstitute.com/resources/valuation/cost-of-debt/

- https://www.investopedia.com/ask/answers/043015/how-does-market-risk-affect-cost-capital.asp

- https://www.indeed.com/career-advice/career-development/equity-vs-capital

- https://companiesmarketcap.com/amazon/total-debt/

- https://www.linkedin.com/advice/1/what-cost-capital-why-important-skills-corporate-finance-embxe

- https://www.sec.gov/files/ib_corporatebonds.pdf

- https://www.morganstanley.com/im/publication/insights/articles/article_costofcapital.pdf

- https://www.geeksforgeeks.org/difference-between-debt-and-equity/

- https://www.business.com/articles/business-debt-how-much-is-too-much-to-carry/

- https://breakingintowallstreet.com/kb/debt-equity/debt-vs-equity-analysis/

- https://www.investopedia.com/ask/answers/032515/what-difference-between-cost-debt-capital-and-cost-equity.asp

- https://www.nirmalbang.com/knowledge-center/debt-to-equity-ratio.html

- https://www.investopedia.com/ask/answers/042215/what-are-benefits-company-using-equity-financing-vs-debt-financing.asp

- https://www.careerprinciples.com/resources/weighted-average-cost-of-capital-wacc

- https://www3.mtb.com/business/business-education-portal/how-to-finance-your-small-business/debt-financing-vs-equity-financing-options

- https://www.investopedia.com/terms/c/costofcapital.asp

- https://corporatefinanceinstitute.com/resources/commercial-lending/debt-vs-equity/

- http://www.oeconomica.uab.ro/upload/lucrari/920071/33.pdf

- https://carnegieendowment.org/chinafinancialmarkets/86397

- https://fastercapital.com/content/Ways-To-Lower-The-Cost-Of-Capital-For-A-Small-Business-Start-Up.html

- https://finmark.com/equity-financing/

- https://www.theforage.com/blog/skills/wacc

- https://equifund.com/blog/how-to-use-debt-to-build-wealth/

- https://cfo.university/library/article/what-is-the-difference-between-wacc-and-irr-nilantha

- https://www.findlaw.com/smallbusiness/business-finances/debt-vs-equity-advantages-and-disadvantages.html

- https://homework.study.com/explanation/what-role-does-the-cost-of-capital-play-in-the-overall-financial-decision-making-of-the-firm-s-top-managers.html

- https://www.investopedia.com/terms/o/overleveraged.asp

- https://www.investopedia.com/terms/w/wacc.asp

- https://www.toppr.com/ask/question/the-cost-of-capital-declines-when-the-degree-of-financial-leverage-increases-who-advocated-it/

- https://carofin.com/knowledge-base/company/why-do-companies-use-debt-financing/

- https://companiesmarketcap.com/netflix/total-debt/

- https://www.nasdaq.com/articles/4-borrowing-rules-rich-people-follow-but-others-often-dont

- https://en.wikipedia.org/wiki/Debt_capital

- https://www.investopedia.com/terms/d/debt-issue.asp

- https://www.coursehero.com/file/p23i6ql7/The-cost-of-capital-depends-primarily-on-the-use-of-the-funds-not-the-source/

- https://www.marketwatch.com/picks/i-have-20k-in-credit-card-debt-and-pay-400-a-month-just-in-interest-im-worried-about-this-large-sum-of-interest-im-paying-what-should-i-do-01675358619

- https://www.quora.com/Is-cost-of-debt-ever-higher-than-cost-of-equity

- https://www.nibusinessinfo.co.uk/content/advantages-and-disadvantages-equity-finance

- https://www.nationalfunding.com/blog/how-knowing-your-debt-to-capital-ratio-can-help-with-financing-decisions/

- https://in.indeed.com/career-advice/career-development/what-is-equity-financing

- https://www.comparables.ai/articles/weighted-average-cost-of-capital-wacc-or-discount-rate-analysis

- https://www.citizensbank.com/learning/how-much-debt-is-too-much.aspx