What three factors determine cash flow for an organization?

By understanding operations, investing, and financing, business owners can create a precise and informative cash flow statement. Business owners typically can't manage what they can't measure. Better cash-flow management can start with examining three primary sources: operations, investing, and financing.

Key Takeaways

The cash flow statement is broken down into three categories: Operating activities, investment activities, and financing activities.

The three main components of a cash flow statement are cash flow from operations, cash flow from investing, and cash flow from financing.

- Operating.

- Investing.

- Financing.

There are three factors that determine cash flows: sales, after-tax operating profit margins, and capital requirements.

The Standard deals with the provision of information about the historical changes in cash and cash equivalents of an enterprise by means of a cash flow statement which classifies cash flows during the period from operating, investing and financing activities.

Cash flow refers to money that goes in and out. Companies with a positive cash flow have more money coming in, while a negative cash flow indicates higher spending. Net cash flow equals the total cash inflows minus the total cash outflows. U.S. Securities and Exchange Commission.

| Particulars | AS 3 Cash Flow Statements |

|---|---|

| Cash flow from extraordinary activities | AS 3 necessitates cash flows related to the extraordinary activities to be classified as cash flow arising from operating, financing and investing activities |

- Payments made to suppliers.

- Payments made to clear borrowing such as bank loans.

- Money used to purchase any fixed assets.

- Dividends paid out to any shareholders.

- Salaries and wages paid to employees.

- Any transport costs – such as vehicle leasing fees – related to business use.

Free cash flow (FCF) is one of the most common ways of measuring cash flow. This metric tracks the amount of cash you have left over after capital expenditure items like equipment and mortgage payments.

What are the three sections of cash flows and what do they involve?

The operating section of the statement of cash flows will represent the cash inflows and outflows from operating activities. Investing activities represent a company's cash flows from the acquisition or sale of noncurrent assets. Financing activities will include cash flows from debt and equity activities.

The Statement of Cash Flows Reports cash inflows and outflows in three broad categories: 1) Operating Activities, 2) Investing Activities, and 3) Financing activities.

That bottom line is calculated by adding the money received from the sale of assets, paying back loans or selling stock and subtracting money spent to buy assets, stock or loans outstanding. Finally, financing cash flow is the money moving between a company and its owners, investors and creditors.

Summary. Net Cash Flow = Total Cash Inflows – Total Cash Outflows. Learn how to use this formula and others to improve your understanding of your cash flow.

How Can You Increase Cash Flow? Ways to increase cash flow for a business include offering discounts for early payments, leasing not buying, improving inventory, conducting consumer credit checks, and using high-interest savings accounts.

1. An enterprise should prepare a cash flow statement and should present it for each period for which financial statements are presented. 2. Users of an enterprise's financial statements are interested in how the enterprise generates and uses cash and cash equivalents.

Planning for the future, assessing future performance, predicting future goal accomplishments, and identifying cash shortages are the uses of a cash flow forecast.

Wise money managers get the most from their limited incomes through careful planning, saving, and spending. They set goals, make wise decisions, buy wisely, and live within their incomes.

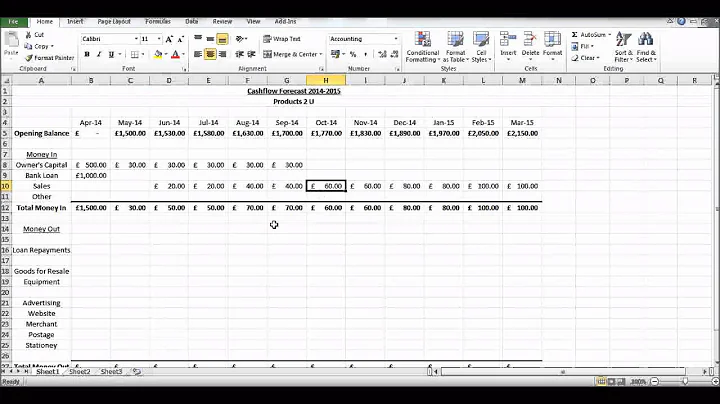

Cash flow forecasts should contain four main categories of information: expected income, projected dates for when you'll receive that income, expected costs, and projected dates for when those costs will be incurred.

If a business's cash acquired exceeds its cash spent, it has a positive cash flow. In other words, positive cash flow means more cash is coming in than going out, which is essential for a business to sustain long-term growth.

What is the most common cash flow method?

Many accountants prefer the indirect method because it is simple to prepare the cash flow statement using information from the income statement and balance sheet. Most companies use the accrual method of accounting, so the income statement and balance sheet will have figures consistent with this method.

Stable Cash Flow From Operating Activities (CFO)

Start by keeping track of your cash flow from operating activities over some time. If it's steady over the years, then it's a good sign. Look at the core business if the line's erratic with significant spikes and dips.

Operating Activities

It's considered by many to be the most important information on the Cash Flow Statement. This section of the statement shows how much cash is generated from a company's core products or services.

What Is the Balance Sheet Formula? A balance sheet is calculated by balancing a company's assets with its liabilities and equity. The formula is: total assets = total liabilities + total equity.

The statement of cash flow is divided into three sections to know the sources of the fund. It is also used for the management's knowledge on the movement of the cash for each activities and to know what activities the cash outflow and inflow are active.

References

- https://oer.pressbooks.pub/utsaccounting1/chapter/prepare-a-cash-budget/

- https://www.bizmanualz.com/tighten-accounting-controls/cash-cycle-procedures.html

- https://www.shortform.com/blog/robert-kiyosaki-cashflow/

- https://www.studysmarter.co.uk/explanations/business-studies/financial-performance/cash-flow-forecast/

- https://www.investopedia.com/articles/analyst/03/122203.asp

- https://fullyaccountable.com/how-to-monitor-cash-flow/

- https://www.linkedin.com/advice/0/how-do-you-audit-verify-cash-flow-statement-using-direct

- https://onlinemba.wsu.edu/blog/four-keys-to-cash-management

- https://www.touchfinancial.co.uk/what-is/what-is-a-cash-flow-ratio/

- https://taulia.com/glossary/what-is-the-cash-conversion-cycle-ccc/

- https://www.netsuite.com/portal/resource/articles/financial-management/cash-flow-analysis.shtml

- https://www.moderntreasury.com/learn/cash-management

- https://quizlet.com/27536410/ch-6-internal-control-cash-and-merchandise-sales-flash-cards/

- https://www.mca.gov.in/Ministry/pdf/AS3_16012018.pdf

- https://www.russellbedford.us/news/5-methods-to-achieve-better-cash-management/

- https://www.highradius.com/resources/Blog/6-best-practices-cash-managers-use-to-streamline-their-cash-management-process/

- https://www.shiksha.com/online-courses/articles/cash-management-and-its-need-blogId-145389

- https://tipalti.com/accounting-hub/cash-flow-management/

- https://www.mineraltree.com/blog/cash-flow-management/

- https://blog.therongroup.org/cash-management-models/

- https://www.shopify.com/nz/blog/positive-cash-flow

- https://homework.study.com/explanation/which-of-the-following-is-the-basic-internal-control-procedure-with-respect-to-cash-receipts-a-depositing-all-cash-receipts-in-the-bank-shortly-after-the-cash-is-received-b-requiring-customers-to-pay-with-debit-or-credit-cards-c-requiring-the-accounta.html

- https://biz.libretexts.org/Bookshelves/Accounting/Intermediate_Financial_Accounting_1__(Arnold_and_Kyle)/06%3A_Cash_and_Receivables/6.06%3A_Appendix_A-_Review_of_Internal_Controls_Petty_Cash_and_Bank_Reconciliations

- https://www.netsuite.com/portal/resource/articles/accounting/cash-management.shtml

- https://cleartax.in/s/as-3-cash-flow-statements

- https://www.investopedia.com/investing/what-is-a-cash-flow-statement/

- https://www.tradefinanceglobal.com/treasury-management/cash-liquidity-management/

- https://www.shopify.com/retail/balancing-a-cash-drawer

- https://business.bankofscotland.co.uk/business-resource-centre/insights-and-ideas/9-ways-to-improve-cash-flow.html

- https://homework.study.com/explanation/which-is-the-most-important-source-of-cash-flows-operating-investing-or-financing-activities-defend-your-response.html

- https://www.highradius.com/resources/Blog/cash-and-liquidity-management-with-importance-and-types/

- https://www.shrm.org/topics-tools/tools/job-descriptions/cash-coordinator

- https://www.usbank.com/financialiq/manage-your-business/cash-management/8-ways-for-small-business-owners-to-manage-their-cash-flow.html

- https://goquantive.com/blog/why-excess-cash-impedes-your-growth/

- https://quizlet.com/83336827/chapter-12-statement-of-cash-flows-flash-cards/

- https://www.investopedia.com/articles/investing/102413/cash-flow-statement-reviewing-cash-flow-operations.asp

- https://statrys.com/blog/tips-for-managing-cash-flow

- https://www.ecb.europa.eu/euro/cash_strategy/cash_role/html/index.en.html

- https://www.investopedia.com/terms/c/cash-flow-from-operating-activities.asp

- https://www.calxa.com/3-way-forecasting/

- https://www.inc.com/encyclopedia/cash-flow-statement.html

- https://fastercapital.com/startup-topic/components-of-cash-flow.html

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/cash-management/

- https://www.investopedia.com/articles/personal-finance/061215/10-ways-improve-cash-flow.asp

- https://www.investopedia.com/terms/c/cashflow.asp

- https://happay.com/blog/global-cash-visibility/

- https://www.freshbooks.com/hub/accounting/cash-flow-formula

- https://flow.space/blog/cash-to-cash-cycle/

- https://www.fieldandmain.com/blog/what-is-cash-management-and-how-can-it-benefit-my-business/

- https://www.financestrategists.com/accounting/management-accounting/cash-management/

- https://www.investopedia.com/articles/personal-finance/040915/how-much-cash-should-i-keep-bank.asp

- https://www.financestrategists.com/wealth-management/financial-statements/cash-flow-statement/cash-flow-planning/

- https://www.digitalocean.com/resources/article/cash-flow-vs-profit

- https://www.diligent.com/resources/blog/internal-controls-for-cash

- https://online.hbs.edu/blog/post/how-to-prepare-a-cash-flow-statement

- https://taulia.com/glossary/what-is-cash-flow-forecasting/

- https://www.paystand.com/blog/how-to-evaluate-your-cash-flow-health

- https://www.hamilton.edu/offices/business/general-ledger/internal-controls-over-cash

- https://www.netsuite.co.uk/portal/uk/resource/articles/financial-management/cash-flow-problems-solutions.shtml

- https://www.indeed.com/career-advice/career-development/cash-budgets

- https://www.unleashedsoftware.com/blog/common-cash-flow-problems-how-to-solve-them

- https://controller.ucsf.edu/reference/accounting-reporting/campus-key-controls

- https://www.kyriba.com/resource/what-is-cash-and-liquidity-management/

- https://business.vic.gov.au/business-information/finance/cash-flow/improve-your-cash-flow

- https://www.fool.com/the-ascent/small-business/accounting/articles/cash-budget/

- https://brainly.com/question/38007572

- https://homework.study.com/explanation/which-of-the-following-is-not-a-basic-principle-of-cash-management-keep-inventory-levels-low-increase-the-speed-of-collection-on-receivables-delay-payment-of-liabilities-maintain-idle-cash.html

- https://www.investopedia.com/terms/i/indirect_method.asp

- https://gocardless.com/guides/posts/how-to-prepare-cash-flow-statement/

- https://ipe.ro/rjef/rjef1_10/rjef1_10_15.pdf

- https://www.tutorhelpdesk.com/homeworkhelp/Finance-/Motives-Holding-Cash-Assignment-Help.html

- https://www.uschamber.com/co/start/strategy/why-small-businesses-fail

- https://medium.com/@chapter3.ventures/beyond-passive-income-the-3-pillars-of-consistent-cashflow-f63d525e94fa

- https://www.americanexpress.com/en-gb/business/trends-and-insights/articles/how-to-calculate-cash-flow/

- https://www.educba.com/cash-management/

- https://finance.syr.edu/audit/general-internal-controls/internal-control-types-and-activities/

- https://gocardless.com/guides/posts/cash-outflow-definition-calculation-and-examples/

- https://www.business.qld.gov.au/running-business/finance/improve-performance/cash-flow

- https://homework.study.com/explanation/why-is-the-statement-of-cash-flows-divided-into-three-sections.html

- https://www.unomaha.edu/nebraska-business-development-center/_files/publications/cash-flow.pdf

- https://www.toptal.com/finance/cash-flow-consultants/how-to-prepare-cash-flow-statement

- https://egyankosh.ac.in/bitstream/123456789/80058/3/Unit-18.pdf

- https://www.investopedia.com/terms/b/balancesheet.asp

- https://quizlet.com/explanations/questions/one-of-the-first-considerations-in-cash-management-is-a-to-have-as-much-cash-as-possible-on-hand-b-synchronization-of-cash-inflows-and-cash--426e25d0-3f781120-62d2-4168-b0b9-73a3d56dc830

- https://brainly.in/question/34725664

- https://www.experian.co.uk/blogs/latest-thinking/small-business/why-is-cash-flow-management-important/

- https://www.zoho.com/books/guides/what-is-a-cash-flow-statement.html

- https://www.accountingdepartment.com/blog/6-ways-to-measure-cash-flow-which-is-best-for-your-business

- https://study.com/academy/lesson/control-of-cash-definition-methods.html

- https://www.invoicera.com/blog/financial-management/10-ways-to-prepare-a-cash-flow-statement-model-that-actually-balances/

- https://www.mycfong.com/traditional-cash-flow-management/

- https://www.superfastcpa.com/what-is-a-minimum-cash-balance/

- https://www.abc-amega.com/articles/understanding-the-cash-flow-statement/

- https://www.investopedia.com/articles/investing/041515/why-cash-management-key-business-success.asp

- https://www.mosaic.tech/financial-metrics/cash-in-out

- https://www.rgcocpa.com/news/what-is-cash-flow-and-how-does-it-affect-your-business/

- https://homework.study.com/explanation/what-are-the-two-main-functions-of-cash-control-systems-a-control-over-receipts-and-control-over-payments-b-control-over-cash-and-control-over-purchase-orders-c-control-over-checks-and-control.html

- https://quizlet.com/470477530/1a-ch-4-tools-and-techniques-flash-cards/

- https://www.mca.gov.in/Ministry/notification/pdf/AS_3.pdf

- https://www.unlv.edu/qafc/resources/cash-control

- https://www.highradius.com/resources/glossary/cash-management/

- https://www.salesforce.com/in/resources/articles/what-to-know-about-order-to-cash-process/

- https://agicap.com/en/article/cash-flow-management/

- https://www.houstonisd.org/cms/lib2/TX01001591/Centricity/Domain/24302/POB%20Ch16.ppt

- https://www.investopedia.com/articles/stocks/07/easycashflow.asp

- https://www.ziprecruiter.com/career/Cash-Controller/What-Is-How-to-Become

- https://www.universalcpareview.com/ask-joey/what-are-the-three-sections-of-the-cash-flow-statement/

- https://www.americanexpress.com/en-us/business/blueprint/resource-center/finance/how-long-can-a-business-operate-with-negative-cash-flow/

- https://www.highradius.com/resources/Blog/what-is-cash-positioning/

- https://www.investopedia.com/terms/i/internalcontrols.asp

- https://www.sumup.com/en-gb/invoices/invoicing-essentials/6-ways-to-improve-cash-flow-in-your-business/

- https://www.sai.ok.gov/Search%20FormsPubs/database/TopTenThingsICanDoToStrengthenInternalControlsInMyOfficeDocBW.pdf

- https://dealhub.io/glossary/opportunity-to-cash/

- https://navi.com/blog/cash-management/

- https://homework.study.com/explanation/which-of-the-following-is-not-an-internal-control-activity-for-cash-a-unannounced-audits-of-cash-on-hand-should-be-made-occasionally-b-the-number-of-persons-who-have-access-to-cash-should-be-limited-c-the-functions-of-recordkeeping-and-keeping-custo.html

- https://www.thehartford.com/business-insurance/strategy/manage-cash-flow/best-practices

- https://www.investopedia.com/terms/c/cash-management.asp

- https://study.com/academy/lesson/cash-budget-definition-examples.html

- https://happay.com/blog/cash-management-system/

- http://e-journal.uajy.ac.id/9739/1/JURNAL%20SUMMARY.pdf

- https://learn.microsoft.com/en-us/dynamics365/guidance/business-processes/service-to-cash-introduction

- https://controller.berkeley.edu/accounting-and-controls/internal-controls