Why do banks offer CDs?

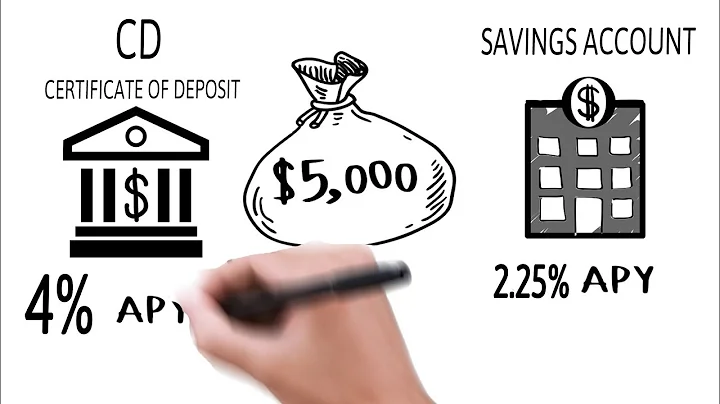

Because CD account holders can't take their money back at a moment's notice like savings account holders can, CDs are more valuable to banks than savings deposits. Banks typically pay CD investors a higher yield in exchange for locking up their money for a set term.

CDs offer all banks a kind of stability, according to financial risk consultant Mayra Rodriguez Valladares. “They want more people and certificates of deposits, because then individuals are a lot less likely to withdraw their money,” she said.

The bank makes profits by charging higher interest on money that is lent out than the interest that is paid to depositors. However, banks are obligated to pay back the depositors' funds whenever they withdraw it. Therefore, there is a risk that many depositors may withdraw their funds simultaneously.

| Top Nationwide Rate (APY) | Balance at Maturity | |

|---|---|---|

| 1 year | 6.18% | $ 10,618 |

| 18 months | 5.80% | $ 10,887 |

| 2 year | 5.60% | $ 11,151 |

| 3 year | 5.50% | $ 11,742 |

If you're in a position to save in today's higher interest rate environment, investments like CDs could help accelerate your savings. CD rates have skyrocketed over the past two years: 1-year CD rates have increased more than seven-fold, with 3-year and 5-year CDs up nearly four-fold and three-fold, respectively.

Disadvantages of investing in CDs

As noted previously, since CDs have a set interest rate and maturity date, you typically can't withdraw the money from the CD without paying a penalty. The penalty ranges from a minimum of multiple months' worth of interest to more, depending on the bank and term of the CD.

Banks and credit unions often charge an early withdrawal penalty for taking funds from a CD ahead of its maturity date. This penalty can be a flat fee or a percentage of the interest earned. In some cases, it could even be all the interest earned, negating your efforts to use a CD for savings.

One major drawback of a CD is that account holders can't easily access their money if an unanticipated need arises. They typically have to pay a penalty for early withdrawals, which can eat up interest and can even result in the loss of principal.

However, our opinions are our own. See how we rate banking products to write unbiased product reviews. Depending on the bank, a $5,000 CD deposit will make around $25 to $275 in interest after one year.

That all said, here's how much a $1,000 CD will make in a year, based on four possible interest rate scenarios: At 6.00%: $60 (for a total of $1,060 total after one year) At 5.75%: $57.50 (for a total of $1,057.50 total after one year)

Why you should deposit $10,000 in CD now?

The bottom line

If you put $10,000 in a 5-year CD right now, you'd earn more than $2,600 in interest by the end of the term. That's a significant bit of interest, and what's better is that it comes with virtually no risk.

With such high interest rates, the earnings on CDs are impressive. You'll earn $850.50 for a total of $15,850.50 after one year when you open a $15,000 1-year CD with Popular Direct when calculating the returns at current rates.

Plus, you can often earn more in a six-month CD than you would in a high-yield savings account. Six-month CDs are worth it if you know you need to make a major purchase within the year and want to earn as much interest as possible on your money without putting it at risk.

Are CDs safe if the market crashes? Putting your money in a CD doesn't involve putting your money in the stock market. Instead, it's in a financial institution, like a bank or credit union. So, in the event of a market crash, your CD account will not be impacted or lose value.

CD rates may not be high enough to keep pace with inflation when consumer prices rise. Investing money in the stock market could generate much higher returns than CDs. CDs offer less liquidity than savings accounts, money market accounts, or checking accounts.

Remember, it's possible that in two or three years from now, CDs will be paying 2.5% interest at best. So if you can lock in a 5-year CD at 5% now, that means that once things reach that point, you'll continue to earn more interest on your money while savers opening new CDs will be signing up to earn much less.

A one-year CD typically offers a higher interest rate than shorter-term CDs, such as three-month CDs and six-month CDs. Offers higher interest rates than traditional savings accounts.

Use Multiple CDs to Manage Interest Rates

Multiple CDs can help you capitalize on interest rate changes if you believe CD rates will change over time. You might put some cash into a higher-rate 6-month CD and the remainder into a 24-month bump-up CD that allows you to take advantage of CD rate increases over time.

As part of a portfolio that includes cash, CDs can provide stability and security. However, CDs are unlikely to provide you with the returns you need to build wealth for the future or live off the interest — unless you already have a large amount of money and ladder your CDs to avoid penalties.

Standard CDs are insured by the Federal Deposit Insurance Corp. (FDIC) for up to $250,000, so they cannot lose money. However, some CDs that are not FDIC-insured may carry greater risk, and there may be risks that come from rising inflation or interest rates.

Does opening a CD hurt your credit?

The short answer is no, opening a CD generally will not hurt your credit. That's because you're not borrowing money; a CD is a type of savings account, which usually doesn't require a credit check.

However, stocks are much better than CDs for long-term investors who have the time to ride out short-term losses.

Because of those features, CDs tend to be best for short-term investors (with a good idea of when they'll need their money back) or long-term investors (who don't mind CDs' relatively low returns compared with riskier investments). Office of the Comptroller of the Currency.

However, federally insured banks and credit unions only insure up to $250,000 per depositor per account ownership category. If you put more than this amount in a single CD, some of your money will be at risk. You can still safely invest more than $250,000 in CDs by opening accounts at multiple financial institutions.

CDs and money market accounts are equally safe. They are both insured accounts and will not lose value.

References

- https://www.investopedia.com/how-does-a-cd-account-work-5235792

- https://www.forbes.com/advisor/banking/cds/best-1-year-cd-rates/

- https://www.cbsnews.com/news/how-much-does-1000-cd-make-in-a-year/

- https://www.fool.com/the-ascent/banks/articles/heres-why-nows-a-good-time-to-lock-in-a-long-term-cd/

- https://www.cbtcares.com/personal/certificates-of-deposit/

- https://www.bankrate.com/investing/4-ways-to-get-better-returns-than-cds/

- https://www.cnn.com/cnn-underscored/money/6-percent-cd-rates

- https://fortune.com/recommends/investing/pros-and-cons-of-certificates-of-deposit/

- https://www.fool.com/the-ascent/banks/where-put-money-recession/

- https://www.investopedia.com/what-can-i-earn-with-10k-in-a-cd-8400034

- https://www.helpwithmybank.gov/help-topics/bank-accounts/certificates-of-deposit/cd-interest-after-mature.html

- https://www.communityfirstfl.org/resources/blog/how-does-a-certificate-of-deposit-work

- https://www.forbes.com/advisor/banking/savings/7-percent-interest-savings-account/

- https://www.bankrate.com/banking/cds/what-is-a-cd/

- https://www.forbes.com/advisor/banking/cds/are-cds-taxable/

- https://www.investopedia.com/pros-and-cons-of-cds-5223947

- https://fortune.com/recommends/banking/cds-vs-traditional-savings-accounts/

- https://www.forbes.com/advisor/banking/pros-and-cons-of-using-a-certificate-of-deposit-cd-for-your-savings/

- https://www.forbes.com/advisor/banking/cds/how-much-money-to-put-in-a-cd/

- https://www.bankrate.com/banking/cds/how-do-cds-work/

- https://www.investopedia.com/terms/c/certificateofdeposit.asp

- https://bic.nd.edu/instrumentation/cd/

- https://www.bankrate.com/banking/savings/money-market-vs-savings-accounts-vs-cds/

- https://www.forbes.com/advisor/banking/cds/are-cds-worth-it/

- https://www.experian.com/blogs/ask-experian/minimum-deposit-to-open-cd/

- https://fortune.com/recommends/banking/cds-vs-money-market-accounts/

- https://www.investopedia.com/what-happens-to-your-cd-if-your-bank-fails-7511009

- https://www.investopedia.com/cds-vs-stocks-5225343

- https://money.com/money-market-vs-cd/

- https://www.cbsnews.com/news/why-you-should-put-5000-in-a-6-month-cd-now/

- https://www.cnn.com/cnn-underscored/money/are-cds-taxable

- https://www.cbsnews.com/news/why-you-should-put-20000-into-a-5-year-cd-now/

- https://www.cbsnews.com/news/can-you-lose-money-in-a-cd/

- https://www.investopedia.com/how-many-cds-can-i-have-5248694

- https://www.bankrate.com/banking/cds/paying-tax-on-cd-interest/

- https://www.experian.com/blogs/ask-experian/pros-cons-cds/

- https://www.forbes.com/advisor/banking/cds/cd-rate-forecast/

- https://www.investopedia.com/best-1-year-cd-rates-4796650

- https://www.consumerfinance.gov/ask-cfpb/what-is-a-certificate-of-deposit-cd-en-917/

- https://www.investopedia.com/what-can-cds-be-used-for-5235790

- https://www.marketplace.org/2023/03/27/why-cds-are-music-to-banks-ears-right-now/

- https://www.cbsnews.com/news/how-to-avoid-cd-fees/

- https://fortune.com/recommends/banking/should-you-open-certificate-of-deposit-now-or-wait/

- https://www.experian.com/blogs/ask-experian/how-many-cds-can-you-have/

- https://www.bankrate.com/banking/cds/are-cds-worth-it-right-now/

- https://www.marketwatch.com/picks/cd-vs-savings-account-which-should-i-choose-6cc7169d

- https://www.chase.com/personal/banking/education/budgeting-saving/cd-vs-savings-account

- https://www.sofi.com/learn/content/can-a-certificate-of-deposit-cd-lose-value/

- https://www.cbsnews.com/news/why-you-should-put-10000-into-a-short-term-cd-right-away/

- https://www.investopedia.com/ask/answers/060616/can-certificates-deposit-cds-lose-value.asp

- https://www.cnn.com/cnn-underscored/money/how-much-money-should-i-keep-in-a-cd

- https://www.cbsnews.com/news/how-much-will-a-20000-cd-make-in-a-year/

- https://www.businessinsider.com/personal-finance/financial-advisor-cds-bad-place-keep-savings-2023-1

- https://www.discover.com/online-banking/banking-topics/ira-cds-vs-ira-savings-accounts/

- https://corporatefinanceinstitute.com/resources/wealth-management/certificate-of-deposit-cd/

- https://www.cnn.com/cnn-underscored/money/pros-and-cons-of-cds

- https://www.nerdwallet.com/article/banking/when-your-cd-matures

- https://www.nasdaq.com/articles/can-you-transfer-your-401k-to-a-cd-how-to-avoid-penalties

- https://hbr.org/2022/11/how-to-manage-your-money-during-a-recession

- https://www.nerdwallet.com/article/banking/cd-certificate-of-deposit

- https://www.sec.gov/Archives/edgar/data/1818382/000181838222000014/R8.htm

- https://www.investopedia.com/do-cds-pay-compound-interest-5248340

- https://www.nerdwallet.com/article/banking/short-term-or-long-term-cds

- https://www.businessinsider.com/personal-finance/how-much-will-5000-cd-make-in-a-year

- https://www.law.cornell.edu/ucc/3/3-104

- https://www.capitalone.com/bank/money-management/banking-basics/certificate-of-deposit-advantages-and-disadvantages/

- https://www.experian.com/blogs/ask-experian/does-opening-cd-hurt-your-credit/

- https://www.nationwide.com/lc/resources/personal-finance/articles/types-of-assets

- https://www.forbes.com/advisor/banking/cds/best-6-month-cd-rates/

- https://www.bankrate.com/banking/cds/the-pros-and-cons-of-cd-investing/

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2728378/

- https://www.nerdwallet.com/article/banking/are-cds-safe

- https://www.financestrategists.com/banking/negotiable-instrument/

- https://www.cbsnews.com/news/why-you-should-put-15000-into-a-1-year-cd-now/

- https://www.cbsnews.com/news/why-you-should-deposit-10000-into-a-5-year-cd-now/

- https://time.com/personal-finance/article/are-cds-taxable/

- https://www.fool.com/the-ascent/banks/articles/yes-you-can-lose-money-in-a-cd-heres-how/